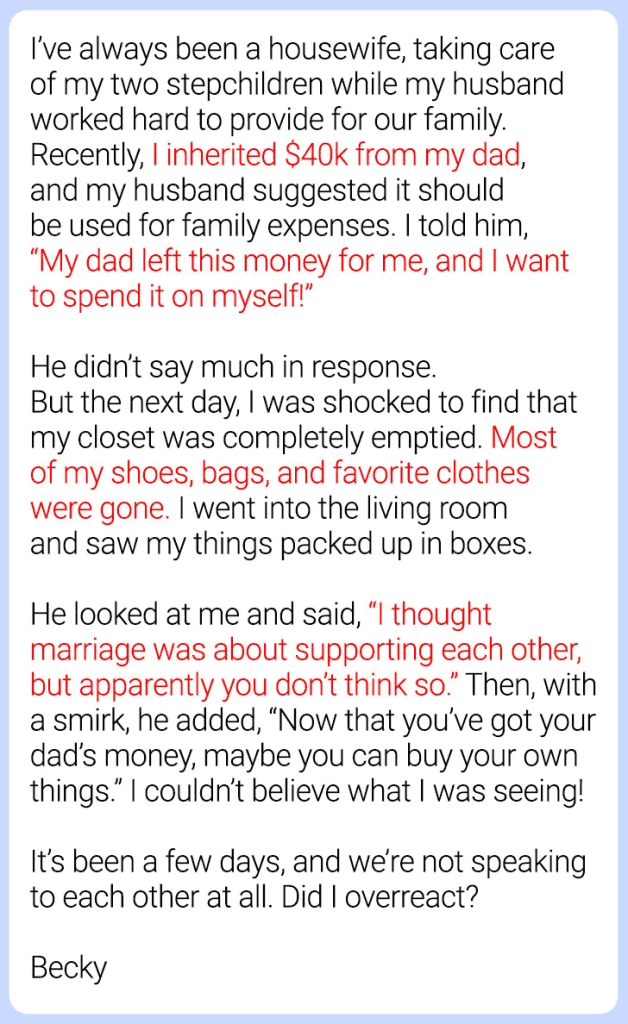

Inheritances often bring about unexpected changes, and for one woman, it stirred up tensions in her marriage. Becky reached out, unsure if she handled things correctly after receiving a financial inheritance that has caused a rift between her and her husband. Below, we dive into Becky’s story, her decision, and explore perspectives on navigating financial independence within marriage.

Becky recently inherited a sum of money from a late relative. This inheritance, which was meant to provide her with financial security and an opportunity for a bit of personal freedom, instead ignited conflict in her household. Although excited about the opportunity this windfall presented, Becky soon found herself in the midst of a disagreement with her husband over how the money should be used.

Her husband believed that since they were a married couple, the inheritance should go into their joint funds to benefit the family as a whole. However, Becky had different plans. Having been a stay-at-home mom, she had dedicated herself to managing the household and raising their children, all while her husband provided financially. She saw the inheritance as a chance to do something meaningful for herself—something she hadn’t been able to do as a full-time homemaker.

Rather than immediately placing the inheritance in their shared bank account, Becky made a bold decision: she would keep the inheritance separate, using it to pursue something that was purely hers. She wanted to explore a small business venture, put some aside for her own retirement, and use part of it as a safety net. Her intention wasn’t to undermine her husband’s contributions, but to take control over an opportunity that felt empowering.

However, this decision didn’t sit well with her husband, who perceived it as a betrayal of their mutual financial responsibilities. Their shared understanding of finances had always been that everything earned was for the family. Her husband felt that the inheritance should be treated the same way, and he voiced his frustration, leaving Becky uncertain about her choice.

Financial disagreements in marriage are common, and in many cases, they stem from differing philosophies about money. For couples like Becky and her husband, tension arises when personal values around financial independence conflict with shared expectations. Inheritances, in particular, add a unique layer of complexity. While they are legally considered separate assets, the emotional and relational ties can make decisions about them difficult.

For Becky, this inheritance symbolized freedom and a form of independence she hadn’t experienced in years. For her husband, it challenged the very foundation of their partnership. Understanding both perspectives is crucial in navigating this situation with empathy and clarity.

Several reasons might justify Becky’s decision to keep her inheritance separate:

- Acknowledging Her Contribution as a Homemaker: As a stay-at-home mom, Becky’s work in raising children and managing the home has greatly benefited the family, even if it wasn’t financially compensated. This inheritance gives her a chance to have her own financial autonomy, which many full-time caregivers often lack.

- Pursuing Personal Goals: Financial independence can foster a sense of personal accomplishment. By investing in a business or personal development, Becky could contribute to her family’s future in new ways, ultimately benefiting everyone in the long run.

- Retirement Security: In many relationships where one partner is a homemaker, that partner may feel less financially secure, especially when it comes to retirement. Having personal funds set aside could provide Becky with peace of mind and a sense of financial safety, should unforeseen circumstances arise.

While Becky’s decision to keep the inheritance separate was personal, her husband’s reaction highlights the importance of transparency and communication in financial matters. Here are some strategies that can help foster mutual understanding:

- Honest Dialogue About Expectations: Clear, open conversations about financial goals and boundaries can help both partners understand each other’s intentions. Becky could explain that her desire to use the inheritance independently doesn’t imply a lack of commitment to the family but is a personal opportunity she values.

- Recognizing Each Partner’s Contribution: Often, the contributions of a stay-at-home partner aren’t fully appreciated. Becky could have a candid discussion about the unpaid labor she contributes daily, which has allowed her husband to work and provide. Recognizing both financial and non-financial contributions could shift the perspective of fairness in their partnership.

- Compromise and Planning Together: In some cases, allocating a portion of the inheritance toward shared goals could help bridge the divide. Becky might agree to set aside part of the inheritance for family use while reserving some funds for her personal pursuits. Compromises like these can create a balance that respects both partners’ values.

Sometimes, disagreements over finances reveal underlying relationship dynamics. For Becky and her husband, this situation has highlighted the need for mutual respect and trust, especially in how they view financial contributions. The issue is no longer just about the inheritance; it’s about how they each perceive their role in the family and their individual identities.

Becky’s desire for financial independence could be a signal of her need for recognition beyond traditional roles, while her husband’s frustration may indicate a deeper concern about unity and loyalty. Addressing these underlying issues could help them find common ground and strengthen their partnership.

The challenge for Becky lies in finding a balance that honors both her desire for independence and her commitment to her family. Money matters, especially those involving inheritances, should always consider both individual and shared needs within a marriage.

- Establishing Financial Boundaries: For some couples, setting clear boundaries around personal finances versus shared assets can create a healthier dynamic. These boundaries don’t imply selfishness; rather, they ensure that each partner feels respected and valued.

- Prioritizing Long-Term Goals: Becky and her husband could use this inheritance to further long-term financial goals, such as retirement, children’s education, or future investments. This approach could help both partners see the inheritance as an opportunity to build a secure future together.

When financial disagreements become too emotionally charged to resolve, seeking outside support, like counseling or financial advice, can be beneficial. A financial counselor can help couples like Becky and her husband navigate the complexities of finances with impartial advice, while a therapist can address the underlying relational tensions that finances can sometimes exacerbate.

Becky’s story reflects a common struggle faced by many couples: balancing financial independence with shared commitments. While inheritances can provide a sense of freedom and security, they can also create conflict when partners have differing views on money. Becky’s journey highlights the importance of clear communication, mutual respect, and compromise.

Ultimately, financial harmony in marriage is not about having identical views but about respecting each other’s individual needs and contributions. By working through these issues with honesty and understanding, Becky and her husband have the opportunity to strengthen their partnership and create a balanced approach to their financial future.